It’s like finding a reduction with your house loan fascination costs, which may help you spend less during the early many years of homeownership.

In August, the Supreme Courtroom retained on keep the Help you save prepare, the cash flow-driven repayment system that will have decreased payments for many borrowers, even though lawsuits make their way by means of lower courts.

will be the payment? Very well, it depends on how big your loan is. That’s as the fee a lender costs to get a three-2-one mortgage buydown might be Just about the same as the level of fascination you’ll preserve throughout the a few many years it’s in influence.

Availability: Your capacity to take full advantage of a buydown could possibly be restricted by the kind of assets concerned or the kind of mortgage loan for which you’re applying.

What's a Buydown? A buydown is actually a home finance loan financing strategy with which the buyer tries to get a reduced interest level for a minimum of the primary couple of years from the property finance loan or maybe its overall daily life.

Meanwhile, the buydown fee for this loan improves to $11,324. So When contemplating a buydown, it is important to search outside of the Original minimal payment time period to find out whether the expenditures involved in the close to phrase are worth any interest price savings you would possibly know.

The information contained herein is of a typical nature and is not intended to tackle the situations of any particular specific or entity. Even though we endeavor to supply precise and well timed data, there may be no warranty that this sort of information is accurate as on the date it can be been given or that it'll continue to become exact Sooner or later.

Your credit score and credit score record are critical towards the home loan course of action. In this guidebook, we stop working the basic principles of credit score scores and give important strategies on how to deal with your rating. Start out from the beginning or soar in wherever you might be to continue! Fundamental principles of Credit score Scores Introduction…

It’s vital to evaluate your prolonged-time period designs and evaluate whether or not the financial savings outweigh the upfront prices.

Other Methods to cut back Property finance loan Rates Alternatively, purchasers can choose to purchase price get more info reduction details to order down their interest rate. During this situation, the customer pays dollars up front to invest in the details, plus the lender lowers their desire fee Because of this.

Quickly Loan Direct advises borrowers to be familiar with private loans, warning that making use of for the utmost sum can improve repayment burdens. The corporation endorses assessing repayment means and loan necessity to balance quick wants with very long-expression pitfalls, endorsing responsible borrowing.

Credit rating score of 300 on at the least one credit score report (but will take applicants whose credit score historical past is so insufficient they haven't got a credit history score)

If you have any university student loans which have been in default, the Division of Instruction is giving you until eventually Oct. 2 at three a.m. ET to submit an application for the Refreshing Start off plan to acquire them back in good standing so you can likely qualify for income-pushed repayment programs and forgiveness programs.

At CNBC Select, our mission is to supply our audience with large-top quality company journalism and detailed buyer tips to allow them to make informed decisions with their income. Each particular loan article is based on arduous reporting by our workforce of professional writers and editors with comprehensive knowledge of loan products.

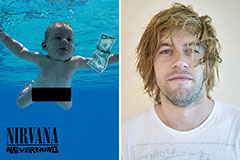

Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Shane West Then & Now!

Shane West Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!